State Grants

In addition to existing benefits, such as strategic geographical location, duty-free exports to the countries of South Eastern Europe and Russia, the lowest corporate tax rate in Europe of 15% as well as an educated and skilled labor force available at competitive cost, Serbia has prepared a package of financial support to investors.

The funds may be awarded for financing investment projects in the manufacturing sector and the services sector which may be subject to international trade.

Eligible costs are investments in tangible and intangible assets, as of the date of applying for state grants until the deadline for implementation of the investment project, in accordance with state grant contract or gross salaries for new employees associated with the investment project during two years period after reaching full employment. Leasing of business premises are taken into account as an eligible investment costs in which the investment project is implemented, provided that the period of lease, from the completion of the investment project, is not less than five years for large enterprises, and not less than three years for small and medium businesses.

- Investors who have investment projects in sectors that are in accordance with Decree and that apply for grants before the start of the realization of the investment project;

- Users of grants are required to provide a minimum of 25% of eligible costs from their own resources or from other sources, which do not contain state grants;

- Funds for large enterprises can not be allocated before the examination of documents is determined that the allocation of funds will have a beneficial incentive effect i.e. have an impact on:

- the substantial increase in the size of the project, or

- the substantial increase in the total amount of funds that are invested in the project,or

- significantly increasing the speed of implementation of the project, or

- the realization of the project, without which allocating funds could not be achieved.

- To maintain investment at the same location in the local government where the investment, i.e. direct investment, is realized, for at least five years after the implementation of the project for large enterprizes, or at least three years for small and medium-sized businesses;

- Not to reduce number of employees at the Beneficiaries after the implementation of the investment project, over a period of five years for large enterprises, and three years for small and medium enterprises.

User of state grants, upon reaching full employment, in accordance with the agreement on the allocation of the incentives is obliged to pay the agreed salary to every new employee regularly, in accordance with this Regulation.

- Up to 3 years from the date of applying for state grants, that may be extended for up to five years, following a written explaination from the Beneficiaries, if the Council for Economic Development make an assessment that the circumstances that led to the need for extension of the time is objective and that the deadline extension is justified and appropriate;

- For investments of special importance, the deadline for implementation of investment projects and creation of new jobs associated with the investment project, is up to ten years from the the date of applying for state grants.

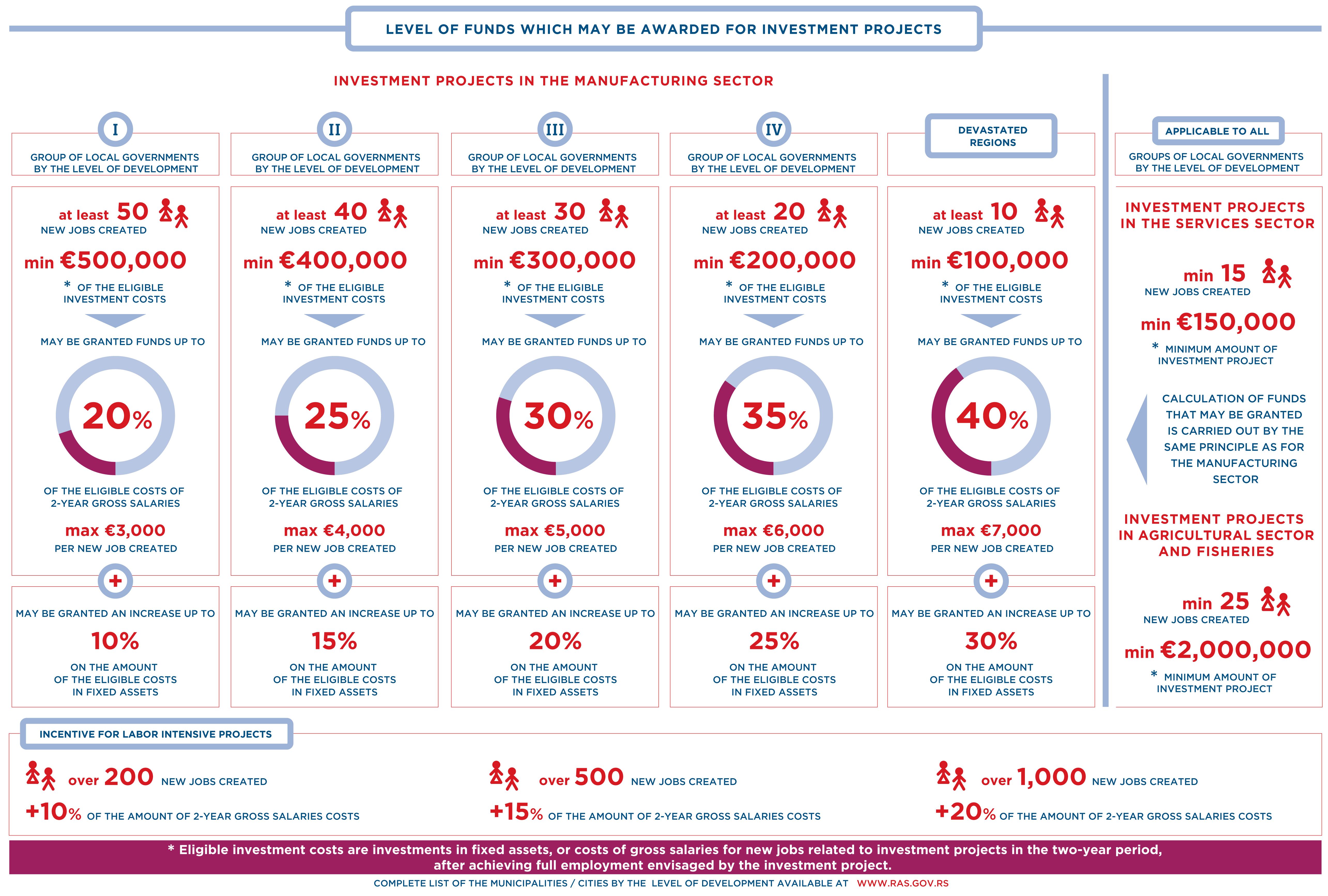

- Create at least 10 jobs and a minimum of EUR 100,000 of the eligible costs of investment in units of local government that are classified in the devastated areas,

- Create at least 20 jobs and a minimum of EUR 200,000 of the eligible costs of investment in units of local government that are classified in the IV group of development,

- Create at least 30 jobs and at least EUR 300,000 of the eligible costs of investment in the units of local government that are classified in the III group of development,

- Create at least 40 jobs and at least EUR 400,000 eligible costs of investment in units of local government that are classified in the II group of development,

- Create at least 50 jobs and at least EUR 500,000 eligible costs of investment in units of local governments that are classified in I group of development,

- Investment projects in the services sector, which may be subject to international trade and in which the minimum value of investment is EUR 150,000, providing at least 15 new jobs,

- Investment projects in the agriculture and fisheries sector, in which the minimum value of investment is EUR 2.000.000 providing at least 25 new jobs.

- Incentives for eligible costs of gross salaries for new jobs – 20% (for the I of municipalities), 25% (for group II) and 30% (for group III), 35% (for IV group) and 40% (for devastated regions) the eligible costs of gross salaries from the Article 3. of this Decree. These amounts are limited to a maximum of 3.000 (for group I), 4.000 (for group II), 5.000 (for group III), 6.000 (for the IV group) and 7.000 euros per new job created (for devastated regions).

- Incentives for eligible investment costs in fixed assets – an increase in the amount of grants may be approved for: up to 10% (for I group of municipalities), 15% (for II group of municipality), 20% (for III group of municipalities), 25% (for the IV group of municipalities) and 30% (for devastated regions).

- Additional incentives for labor-intensive projects – an increase in the amount of grants may be approved for: 10% of the eligible costs of gross salary (for any increase in the number of new jobs created over a number of 200 new jobs), 15% (for any increase in the number of new jobs created over a number of 500 new jobs) and 20% (for any increase in the number of new jobs created over a number of 1,000 new jobs).

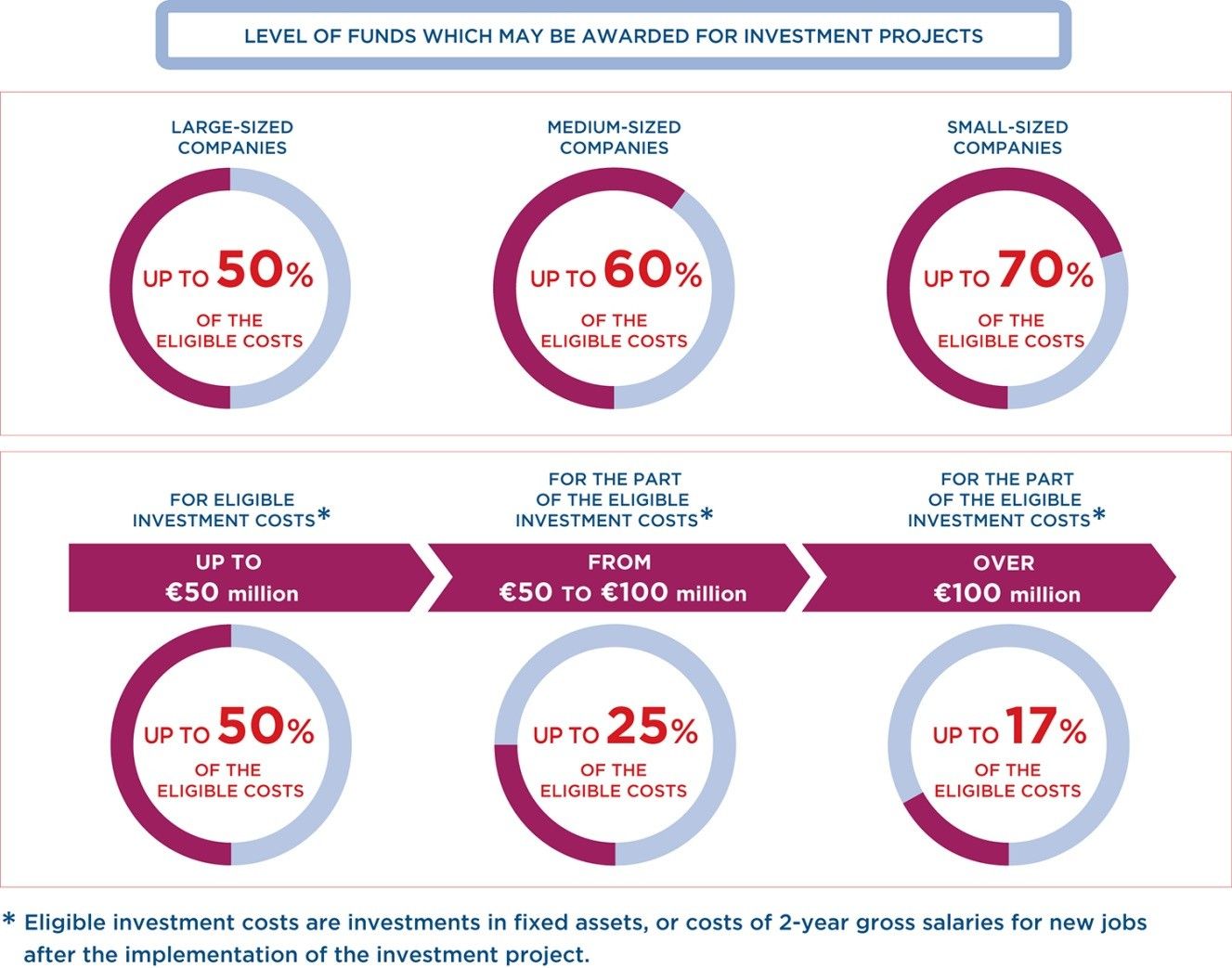

The total amount of funds that may be awarded in accordance with this Decree and other incentives is determined in absolute terms, having in mind that the upper limit may not exceed the amount that is allowed to assign the state grants, in accordance with the regulations governing the rules for granting state grants.

The maximum amount of funds that can be allocated for attracting direct investments shall be determined in accordance with the regulations and criteria of this Decree. In determining the amount of funds that can be allocated, the cumulative pre-approved state grants are taken into consideration, in accordance with the regulations governing the rules for granting state grants.

Funds can not be used to finance investment projects in the transport sector, software development, hospitality industry, gambling, trade, production of synthetic fibers, coal and steel, tobacco and tobacco products, weapons and ammunition, shipbuilding (building seagoing commercial vessels on their own propulsion-at least 100 gross registered tonnes), airports, utilities sector and the energy sector, broadband networks, as well as business entities in difficulties.

Please, find application form here.

The following investors, i.e. Beneficiaries, are excluded from the right to be awarded funds:

- Companies in difficulties, pursuant to the regulations governing the rules for granting state incentives;

- Those with outstanding obligations towards the Republic of Serbia;

- Those that reduced the number of employees for 10% and more in the last 12 months preceding the application submittal;

- Those that are partly owned by the Republic of Serbia, autonomous province or local government;

- Those that are obliged to return unauthorized state grants funds;

- Those that terminated the contract for state grants.

The National Employment Service Grants

The National Employment Service (NES) grants include:

1. the Employment Subsidies Program,

2. the Apprentice Program, and

3. the Re-Training Program.

For further information on the NES programs, see here

Corporate Profit Tax Holiday

Companies are exempt from Corporate Profit Tax for a period of 10 years starting from the first year in which they report taxable profit if they invest an amount exceeding approximately €9 million in fixed assets, and employ at least 100 additional employees throughout the investment period.

Carrying Forward of Losses

The tax loss stated in the tax return can be carried forward and offset against future profits over a period up to 5 years.

Avoiding Double Taxation

If a taxpayer already paid tax on the profit generated abroad, he is entitled to a Corporate Profit Tax credit in Serbia to the already paid amount. The same right is enjoyed by a taxpayer who earns revenue and pays Personal Income Tax in another country, provided there is a Double Taxation Treaty with that country

Reduced Salary Load

Starting from July 1st, 2014 new employment entitles employers to a sizable relief of taxes and contributions paid on net salary from the moment of employment until December 31st, 2017.

- 1-9 new jobs: 65% reduction;

- 10-99 new jobs: 70% reduction;

- 100+ new jobs: 75% reduction.

This reduces the total salary load to very competitive 20%*

*an estimate for an average salary in Serbia

Annual Income Tax Deductions

For non-Serbian citizens, the annual income is taxed if exceeding the amount of threefold the average annual salary in Serbia. The tax rate is 10% for the annual income below the amount of 6 times average annual salary in Serbia, and 15% for the annual income above the amount of 6 times average annual salary in Serbia. The taxable income is further reduced by 40% of an average annual salary for the taxpayer and by 15% of an average annual salary for each dependent member of the family. The total amount of deductions cannot exceed 50% of the taxable income.

Value Added Tax Exemptions in Free Zones

Income generated through commercial activities in the Free Zones in Serbia is exempted from Value Added Tax. There are twelve Free Zones, currently operating in the country: Pirot, Subotica, Zrenjanin, FAS Kragujevac, Sabac, Novi Sad, Uzice, Smederevo, Svilajnac, Krusevac, Apatin, Vranje, Priboj and Belgrade. Foreign companies can establish a privately-owned Free Zone based on the project approved by the government.

Customs-Free Imports of Raw Materials and Semi Finished Goods

Foreign investors in Serbia can enjoy the benefit of customs free import of raw material and semi-finished goods for export oriented production. This benefit can either be achieved by operating in one of the free zones in Serbia or by a permit from custom office for outward processing production. In both cases finished products must be 100% designated for export.

Customs-Free Imports of Machinery and Equipment

Foreign investors are exempt from paying customs duty on imported equipment and machinery which represents the share of a foreign investor in a capital of a company in Serbia.

Local Incentives

A wide array of incentives is also available at the local level, varying in scope and size from one city to another. The major ones comprise the following:

- City construction land lease fee exemptions or deductions, including the option of paying in installments, with the prior consent of the Serbian Government;

- City construction land development fee relief such as fee exemptions or discounts for one-off payments;

- Other local fees exemptions or deductions (e.g. the fee for displaying the company’s name).